Puzzle AI Accounting Software Review: How AI Can Help Improve Accounting Efficiency

If you’re looking for innovative accounting software that will save time and money while providing valuable insights into your finances, Puzzle AI Accounting might be just what you need.

This autonomous software offers predictive bookkeeping, auto-reconciliations, and real-time financials – features that can help grow and scale your business. Whether you’re a startup or an established company, Puzzle’s AI accounting software is designed to streamline financial management, bookkeeping, and forecasting.

In this in-depth review of Puzzle AI Accounting, we’ll closely examine the company’s features, integrations, ease of use, security measures, and compliance standards. We’ll also share customer reviews and delve into the pricing plans available.

By the end of this article, you should better understand how Puzzle can benefit your business and whether it’s the right choice for your accounting needs. So let’s get started!

Key Takeaways From This Puzzle AI Accounting Software Review

- Puzzle AI is an autonomous accounting software that is easy to set up and designed to save time and money while making better financial decisions.

- Puzzle grows and scales with the business, generating financial statements and insights through predictive bookkeeping and auto-reconciliations.

- Puzzle AI works with direct APIs to major banks and card issuers, replacing the need for Quickbooks or expensive experts.

- Puzzle provides a one-stop-shop for financial management, bookkeeping, and forecasting and is recommended by startup founders and CEOs for its intuitive and fun interface.

What is Puzzle Financial?

Puzzle Financial is a start-up founded in 2023 that startup founders and CEOs recommend. It’s an autonomous accounting software that provides a one-stop-shop for financial management, bookkeeping, and forecasting, making it perfect for startups.

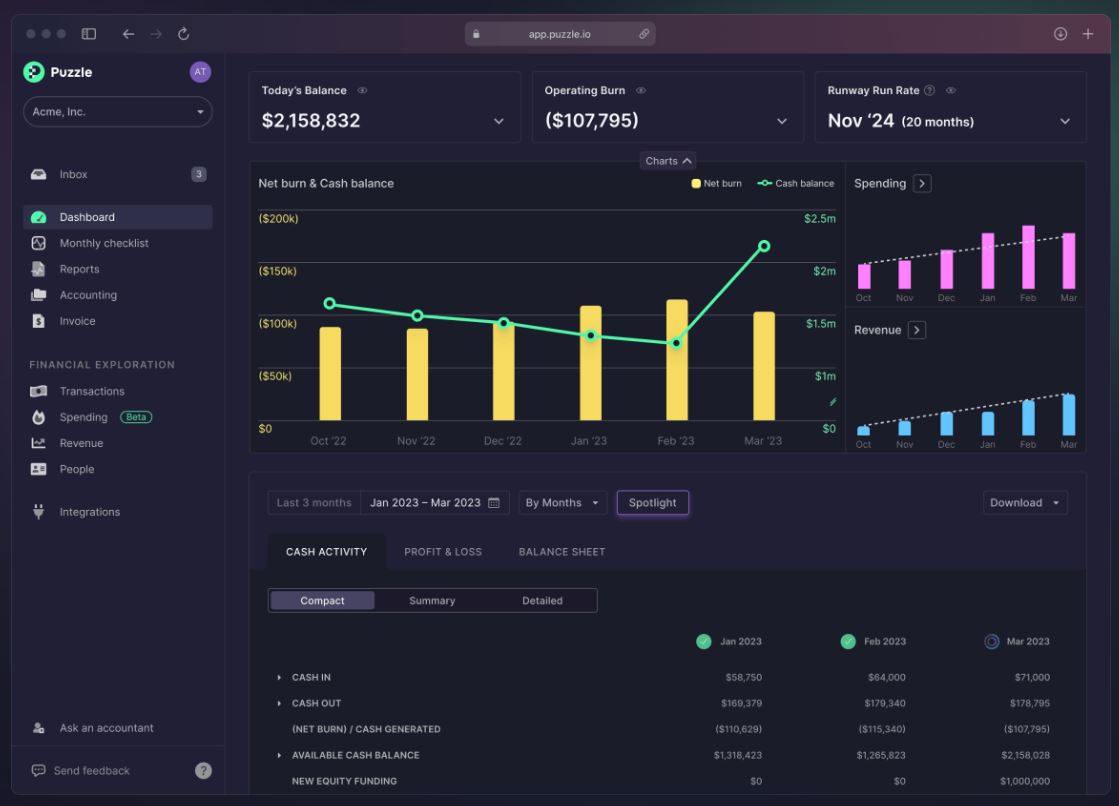

Puzzle helps to aggregate all finances in one dashboard giving you an understandable overview of your company’s financial health. The platform is intuitive and easy to use, instantly giving you a detailed view of cash flow, burn rate and ARR (Annual Recurring Revenue).

With Puzzle Financial at your fingertips, you can save time on taxes with its predictive bookkeeping feature which generates financial statements and insights. The auto-reconciliations also generate reconciliations for review. This means that the platform streamlines the accounting process, saving you money along the way while making better financial decisions. It’s designed to grow with your business, so there’s no need to worry about outgrowing it.

One unique aspect of Puzzle Financial is its AI assistant that learns from you as you work on repetitive tasks like categorizing expenses or tagging transactions. The assistant automates these tasks over time, allowing more time for other important business aspects.

The platform also has an active monthly checklist and automatic rule generation feature, ensuring that nothing falls through the cracks when it comes to managing your finances.

Overall, if you’re looking for transparent accounting software that provides real-time financials and reconciliations while being secure with data control under user purview then Puzzle Financial may be just what you need!

Puzzle AI Accounting Features and Benefits

Get ready to experience the ease and convenience of handling your financials as if you had a personal accountant at your fingertips, like having a magical wand that makes accounting disappear. Puzzle AI Accounting is designed to provide you with the proper financial management tools for your startup or business.

Its user-friendly dashboard helps you aggregate all finances in one place, making it easy to see the big picture of your financial health.

One of the significant benefits of using Puzzle AI Accounting is that it saves time on taxes by providing automatic reconciliations and generating real-time financial statements. You don’t need to spend hours combing through receipts and invoices to determine which expenses are deductible because this software does everything for you. Its predictive bookkeeping feature also generates insights into future cash flow scenarios based on current trends.

Puzzle AI Accounting offers transparent and understandable accounting, perfect for startups who may not have an expert accountant on staff yet. It provides an interface that’s easy to use and instantly gives a detailed view of cash, burn, and ARR (Annual Recurring Revenue). This information allows businesses to make better-informed decisions regarding budgeting and forecasting.

Moreover, unlike other similar solutions where users have limited access or control over their data, Puzzle AI Accounting ensures maximum security with SOC2 compliance standards. Its encryption technology keeps sensitive information safe from cyber threats while still allowing users full access via mobile devices or desktop computers.

Overall, if you’re looking for an autonomous accounting solution that saves time and money while providing valuable insights into your company’s financial health, look no further than Puzzle AI Accounting!

Puzzle AI Accounting Software Integrations

You’ll be pleased to know that Puzzle AI Accounting seamlessly integrates with various major banks and card issuers through Plaid, as well as direct APIs to Stripe, Gusto, Rippling, Brex, Ramp, and Mercury. This means you can easily connect all your financial accounts in one place without manually entering data. It also ensures accurate and up-to-date information for your financial statements.

In addition to these integrations, Puzzle AI can import transactions via CSV files or manual entry. This gives you more flexibility in managing your finances within the platform. Plus, their customer support team can assist you if you have any questions or issues with integrations.

Another benefit of Puzzle’s integrations is that it allows for automatic reconciliations. When transactions are imported from connected accounts or APIs, they’re automatically matched against existing records in the system. This saves time on manual reconciliations and reduces errors.

Overall, Puzzle’s integrations make it easy for startups and small businesses to streamline their finances in one place while ensuring accuracy and efficiency. With multiple options for importing data and automatic reconciliations, managing your finances has never been easier.

Related: Cheatlayer AI Review: Modern Business Automation Software For Everyone

Ease of Use

With Puzzle AI Accounting’s user-friendly interface, managing your finances has never been easier. It’s designed to provide a hassle-free experience for users, regardless of their financial expertise. Here are some reasons why Puzzle is easy to use:

-

Simple dashboard: The dashboard is the first thing you see when you log in. It provides a comprehensive overview of your financial health. You can quickly access all key metrics like cash balance, burn rate, and ARR.

-

Intuitive navigation: The platform is designed to be intuitive and easy to navigate. You don’t need any prior accounting knowledge to get started. Everything is laid out clearly, and the platform has helpful tooltips.

-

Automated workflows: One of the best things about Puzzle is that it automates many of the repetitive tasks associated with bookkeeping and accounting. This saves you time and reduces the chances of errors.

-

Tutorials and support: If you do need help getting started or have questions along the way, Puzzle provides a range of resources to support you. There are tutorial videos that walk you through specific tasks and a dedicated support team that can answer any questions you may have.

Puzzle AI Accounting makes managing your finances straightforward and accessible for everyone – without sacrificing functionality or features. Whether you’re an experienced CFO or just starting out in business, Puzzle has everything you need to easily stay on top of your finances!

Puzzle AI Real-Time Financials

With real-time financials, you can easily track your cash balance, burn rate, and ARR at any given moment. Puzzle AI Accounting provides a dashboard that displays all of this information in an easy-to-understand format.

You no longer have to wait for monthly or quarterly reports to see how your business is doing financially. The real-time financials feature allows you to make informed decisions quickly.

If you notice that your burn rate is higher than expected, you can take action immediately to reduce expenses. On the other hand, if your ARR is increasing rapidly, you can invest more in marketing and sales to continue the growth trend.

Puzzle AI Accounting’s real-time financials also help with tax planning. You can see how much money you have set aside for taxes and adjust accordingly before it’s too late. This feature saves time on taxes by providing accurate information throughout the year instead of scrambling at tax time.

Overall, real-time financials are a game-changer for startups and small businesses. With Puzzle AI Accounting’s intuitive interface and automatic rule generation, tracking finances has never been easier or more transparent. The ability to see your company’s financial health at any given moment empowers you to make better decisions and stay ahead of the competition.

AI Accounting Security and Compliance

When it comes to running your business, keeping your financial data secure and compliant is crucial for protecting both you and your customers. Puzzle AI Accounting understands this and has implemented various security measures to ensure that your data is safe at all times.

Firstly, Puzzle is SOC2 compliant, which means that they have met the strict standards set by the American Institute of Certified Public Accountants (AICPA) for handling sensitive financial information. This ensures that their systems are secure, available, confidential, and process integrity protected.

Secondly, Puzzle uses encryption to protect your data both in transit and at rest. All communication between their servers and other services is encrypted using Transport Layer Security (TLS), while data stored on their servers is also encrypted using Advanced Encryption Standard (AES) 256-bit encryption.

Puzzle conducts regular penetration testing to identify any vulnerabilities in their system before hackers can exploit them. They also maintain an audit log of all activity within the software to detect any suspicious behavior early on.

In summary, you can trust Puzzle AI Accounting with your financial data knowing that they take security seriously. With SOC2 compliance, encryption technology, and regular penetration testing in place, you can focus on growing your business while leaving the accounting to them.

| Security Measures | Details | ||

|---|---|---|---|

| SOC2 Compliance | Meets AICPA standards for handling sensitive financial information | ||

| Encryption | Uses TLS for communication and AES 256-bit for storage | ||

| Penetration Testing | Regular tests conducted to identify vulnerabilities | ||

| Audit Log | Records all activity within the software for detection of suspicious behavior | Regular audits are also conducted by third-party security firms to ensure compliance with industry standards and regulations. |

Puzzle AI Accounting Software Customer Reviews

Users rave about how Puzzle AI Accounting has saved them loads of time and made their financial management a breeze. Many customers have praised the platform for its intuitive interface, which is easy to use right out of the box.

The dashboard provides users with a detailed view of cash, burn, and ARR in real-time, allowing startups to stay on top of their finances without having to spend hours analyzing spreadsheets.

One user wrote that they had been struggling with Quickbooks for years before finally making the switch to Puzzle AI Accounting. They were amazed at how much easier it was to manage their finances using this software. The auto-reconciliations feature saved them countless hours each month, while the predictive bookkeeping generated financial statements and insights that helped them make better financial decisions.

Another customer noted that they appreciated how transparent and understandable accounting had become since switching to Puzzle AI Accounting. They no longer felt like they were drowning in confusing financial jargon or struggling to keep up with tax requirements. Instead, everything was presented clearly on the dashboard, making it easy for them to understand where their money was going and what changes needed to be made.

Overall, customer reviews indicate that Puzzle AI Accounting is an excellent choice for a comprehensive financial management solution for startups. Its native integrations with major banks and card issuers make it easy to aggregate all finances in one place, while its secure data control ensures sensitive information stays protected. With an active monthly checklist and automatic rule generation features, and SOC2 compliance status achieved through encryption and pentest measures – there’s no need to worry about anything except growing your business!

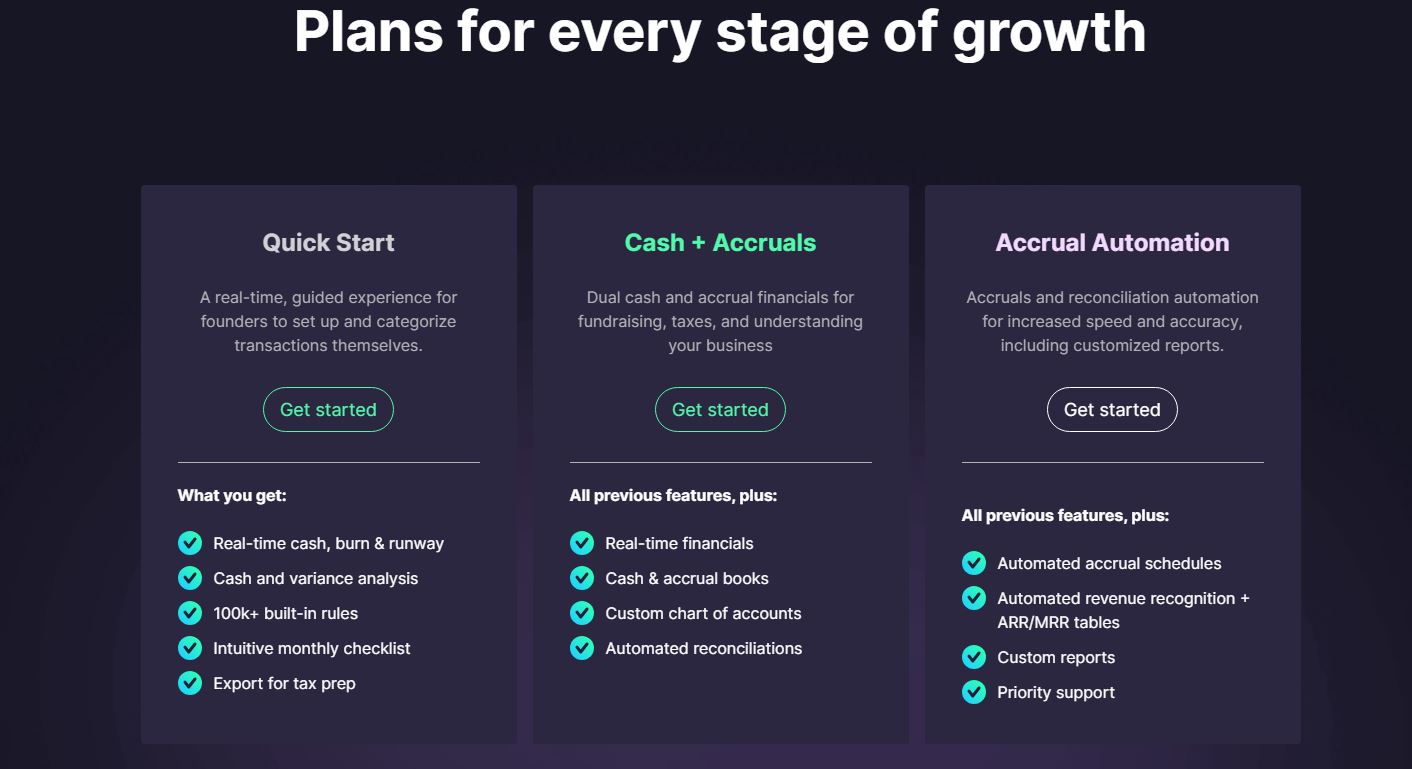

Puzzle AI Pricing and Plans

No matter what plan you choose, Puzzle AI Accounting provides an intuitive interface that makes it easy to track your finances without needing any prior experience in accounting software. Plus, if you have questions about using the platform effectively or need help troubleshooting an issue – their knowledgeable team is always available via email or phone support. So why not give Puzzle AI Accounting a try today?

Related: Bitskout AI Review: Discover The Benefits of AI Workflow Automation

Frequently Asked Questions

Can companies outside of the US use Puzzle AI Accounting?

Using Puzzle AI Accounting is like having a personal financial advisor at your fingertips. Yes, Puzzle AI Accounting can be used by companies outside of the US.

It is designed for newly formed startups using native integrations. Still, it also works with direct APIs to popular services such as Stripe, Gusto, Rippling, Brex, Ramp, Mercury, and via Plaid for other major banks and card issuers. This makes it accessible to businesses worldwide who want to save time and money while making better financial decisions through predictive bookkeeping and auto-reconciliations.

With an intuitive interface that works right out of the box and an AI assistant that learns and automates repetitive work, you’ll have more time to focus on growing your business regardless of location.

Does Puzzle AI Accounting offer support for multiple currencies?

Yes, Puzzle AI Accounting offers support for multiple currencies. It can handle transactions in different countries and currencies thanks to its native integrations and direct APIs to major banks and card issuers via Plaid.

This feature makes it a great option for startups with global operations or those looking to expand internationally. Puzzle’s intuitive interface and real-time financial statements also make it easy to monitor your company’s financial health regardless of where you’re located.

Its predictive bookkeeping and auto-reconciliation features can save you time on taxes and provide transparent accounting no matter what currency you’re dealing with.

Is there a limit to the number of integrations that can be used with Puzzle AI Accounting?

There’s no limit to the number of integrations you can use with Puzzle AI Accounting. The software works directly with APIs from major banks and card issuers, including Stripe, Gusto, Rippling, Brex, Ramp, and Mercury. It also uses Plaid to work with other major financial institutions.

This means you can seamlessly connect all your financial data in one dashboard without worrying about integration limits. Plus, Puzzle’s intuitive interface makes it easy for startups to save time on taxes and get a detailed view of cash flow, burn rate, and ARR.

Does Puzzle AI Accounting offer any training or tutorials for new users?

Did you know that Puzzle AI Accounting has a 2-minute setup time and is designed to save you time and money while making better financial decisions?

Yes, Puzzle AI Accounting offers training and tutorials for new users. Their website provides a comprehensive FAQ section covering all aspects of their product. Additionally, they have a blog where they regularly post helpful articles and tips on how to use their software effectively.

If you still need help or have any questions, their customer support team is available through LinkedIn, Twitter or email. With its intuitive interface and native integrations with major banks and card issuers, Puzzle AI Accounting makes it easy for startups to manage their finances without figuring out accounting using Quickbooks or hiring an expensive expert.

How does Puzzle AI Accounting handle and categorize transactions from multiple sources?

Puzzle AI Accounting is designed to handle and categorize transactions from multiple sources in an intuitive and seamless way. As a user, you can connect your accounts with direct APIs to Stripe, Gusto, Rippling, Brex, Ramp, Mercury or through Plaid for other major banks and card issuers.

The platform uses predictive bookkeeping to generate financial statements and insights while auto-reconciliations generate reconciliations for review. Transactions are automatically categorized based on their source and the system learns from your previous actions to make future categorizations even more accurate.

This saves you valuable time manually sorting through transactions while providing transparent and understandable accounting in real-time.

Conclusion

Congratulations! You’ve just discovered the answer to your financial management prayers. Puzzle Financial’s AI accounting software is a game changer. It offers predictive bookkeeping and real-time financials, saving you time and money while helping you make better financial decisions for your business.

Not only does Puzzle offer top-notch features and integrations, but its security measures ensure that your sensitive information is protected. And don’t just take our word for it – customer reviews rave about this software’s ease of use and effectiveness.

So what are you waiting for? Join the revolution and let Puzzle Financial’s AI accounting software take your business to new heights!